The power of nothing

One of the hardest things about investing is the fact that the thing you most often need to do is nothing. Doing nothing is really hard. Doing nothing means holding tight, sticking with your plan. But there is always something that you feel you ought to react to, something you should sell, something you should buy. John Bogle, founder of Vanguard, has a great rule - 'don't just do something, stand there'. Ben Carlson writes about the power of doing nothing in his recent blog:

Convincing yourself to buy during a bear market is hard. Convincing yourself to hold during a bull market is hard. Figuring out what to do during a sideways market is hard. Watching others make more money in the markets than you is hard. Following a plan when things aren’t going your way is hard. There’s always going to be a reason to do something that goes against your best interests.

When I take on a new client, I explain that the value I add to their lives is not about picking them the best performing investment. I might be able to do that but it's not something I can promise to do with any consistency and not something we can build a multi-decade relationship on. What I will do, more than anything, is help them overcome their tendency to always want to do something. I will help them do nothing when nothing is the right thing to do, because I know that it's what they are going to find the hardest. When the market is falling, I will stop them from panicking, selling and missing the subsequent upturn. When the next bubble comes along I will stop them piling in with everything because someone down the street is getting rich. I will stop them reacting to interest rate rises, political events - Trump, Brexit.

Investing is never easy because it requires us to be so counter-intuitive. As Ben writes:

Holding during a bull market is difficult because you’re always worried about when the music is going to stop. And holding during a bear market is always difficult because you never know how bad things can get.

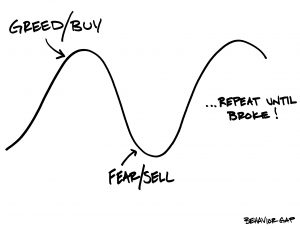

It was Benjamin Graham, Warren Buffett's great mentor, who said 'the investor's chief problem - and even his worst enemy - is likely to be himself'. Or as someone else put it recently, markets don't destroy people, people destroy themselves, over and over again. And they do it because they always want to do something. Carl Richards illustrates it beautifully in his sketch below:

Buying and selling is the easy part of investing - anyone can do that. Holding is the hard part. And holding is what is going to get you where you want to go.